CHINA’S TWO TECHNOLOGY giants are mostly homebodies. Unlike Alphabet’s Google, Amazon and Facebook, which rely on overseas markets for a third or more of their total sales, Alibaba and Tencent collect only a small fraction of their revenue outside of China. But a different story is unfolding in Southeast Asia where, over the last several years, Alibaba and Tencent have spent billions of dollars to secure major equity stakes in the region's leading tech startups.

Investments from the two Chinese giants have stimulated growth and expansion, but have also forced changes in leadership and strategy. In essence, Alibaba and Tencent are creating rival tech ecosystems that mirror their competition in China, and are requiring local startups to choose sides.

For China's tech titans, Southeast Asia has obvious appeal. The 10 markets that make up the Association of Southeast Asian Nations (ASEAN) are home to 640 million people. Were ASEAN a single country, it would be the world's third-most-populous nation and boast the sixth-largest economy. In addition to its geographical proximity to China, ASEAN is home to more than 25 million ethnic Chinese, many of them already familiar with the services the two Chinese companies offer.

And for all its diversity--ethnic, cultural, religious and linguistic--Southeast Asia shares an important characteristic with China: a rising, tech-savvy middle-class. A 2017 report co-authored by Google and Temasek, Singapore's sovereign wealth fund, forecasts that the number of active Internet users in Southeast Asia will reach 480 million by 2020, up from 330 million last year. The study predicts the region's Internet economy--which it defines as the online media, travel, ride-hailing and e-commerce markets--will grow to $200 billion by 2025, a fourfold increase over last year's $50 billion.

While none of the Southeast Asian ventures that Alibaba and Tencent have backed has anything like the kind of scale that the Chinese giants command, they're very prominent in their home markets. And that could make them viable springboards for any effort by Jack Ma and Pony Ma to turn their competition into a truly global one.

Alibaba's e-commerce

To date, Alibaba has invested more boldly than Tencent in Southeast Asia. Alibaba made the first major Chinese investment in the region's tech sector in April 2016 when it paid $1 billion for a 51% stake in Lazada, Southeast Asia's largest e-commerce platform. Last year, Alibaba invested an additional $1 billion, boosting its stake to 83%. In February, the Chinese tech giant doubled down again, bringing its total investment to $4 billion and installing Lucy Peng, one of Alibaba's original 18 founders, as the company's CEO.

Lazada, based in Singapore, was launched in 2011 by German startup studio Rocket Internet. It began as an Amazon clone, accumulating inventory in large fulfillment centers and taking direct responsibility for delivering the products it sold. But now, under Alibaba's direction, the venture is evolving away from the Amazon model to function more like its Chinese parent, which acts as a digital middleman connecting customers to outside vendors and outsources delivery. More than 560 million customers in six Southeast Asian markets use Lazada's platform. Analysts expect Peng, who headed human resources at Alibaba in the company's early years and later led the rapid expansion of mobile payment affiliate Ant Financial, to lay the groundwork for a similar takeoff at Lazada, while integrating the Southeast Asian startup's operations into Alibaba's.

Alibaba has also bet big on Tokopedia, Indonesia's largest e-commerce firm. Tokopedia's founders considered Lazada their main rival and were expected to join forces with Tencent. They had held extensive discussions with Tencent executives and even completed a term-sheet with JD.com, one of Tencent's key strategic allies. But in August 2017, thanks partly to the aggressive intervention of Softbank's Masayoshi Son, an early Alibaba backer, Alibaba pre-empted a Tokopedia deal with Tencent by swooping in and leading a $1.1 billion funding round.

Tencent's gaming-plus play

Tencent, for its part, owns a 40% stake in SEA, a Singapore-based gaming app that raised more than $1 billion in an October 2017 listing on the New York Stock Exchange. Like Tencent, SEA collects much of its revenue through games and web services. The Chinese company has encouraged SEA to broaden its platform into e-commerce and financial payments.

Revenue is rising at SEA, but so are losses, thanks largely to its investment in its mobile e-commerce platform, Shopee.com. In the three months to March, SEA reported revenue of $155 million, up 65% from the same period a year earlier. But net losses during the quarter exceeded $215 million, triple the previous year. In February, founder Nick Nash announced that he would step down as CEO.

Transportation: Up for Grab(s)

Tencent's other major investment in the region is Go-Jek, an Indonesian startup that began as a motorbike-on-demand service and has expanded into ride-hailing for four-wheeled vehicles. Tencent, which led a $1.2 billion funding round for the venture last summer, has encouraged Go-Jek to transform its ride-hailing app into an all-purpose platform similar to Tencent's popular WeChat app.

Alibaba is reportedly in talks to invest in Grab, the Singapore-based ride-hailing venture that is Go-Jek's nemesis. But other funding rounds have been making headlines: Earlier this month, Grab secured a $1 billion investment from Toyota, which valued the company at more than $7 billion, making it the region's most valuable startup. Grab, co-founded by Harvard Business School classmates Anthony Tan and Hooi Ling Tan, operates in eight Southeast Asian markets and dominates ride-hailing in the region with daily orders of over 6 million.

Grab scored another victory this March when San Francisco-based Uber announced plans to withdraw from Southeast Asia and sell its entire operations in the region to Grab for $1.6 billion and a 27.5 percent equity stake. That acquisition has drawn the scrutiny of anti-trust regulators in Singapore, the Philippines and Thailand.

Immediately afterwards, Go-Jek announced plans to invest $500 million to expand into those three markets along with another where Grab operates, Vietnam. In early June, according to Bloomberg, Go-Jek investors including Tencent and Warburg Pincus offered the company an addition $1 billion in funding to compete with Grab.

A version of this article appears in the July 1, 2018 issue of Fortune with the headline "Chess Pieces in Southeast Asia."

ایده ها برای استارت آپ موجب رونق کسب و کارهای اینترنتی

آینده / استارت آپ

استارتآپها ادبیات بازار سرمایه را بلدند؟

استارت آپ

صدور تاییدیه دانش بنیانی شتابدهنده صدر فردا

اخبار / استارت آپ

اپلیکیشن شارژاپ

گوناگون / استارت آپ / رپرتاژ آگهی / بازتاب

جذابترین ایدههای B2B در سال 2020

استارت آپ

تعریف استارت آپ startup

دانشنامه / استارت آپ / مقاله

۱۰ استارتاپ که بدون سرمایه به سوددهی رسیدند

استارت آپ

ایده ها و پیشنهاد برای استارت آپ در سال جدید

راهکارها و ترفند ها / استارت آپ

استارتآپ ایرانی؛ مرجع اول زنان افغان

استارت آپ

شروع یک کسب و کار نوپا پلتفرمی

استارت آپ

برنامه شبکه اجتماعی تیندر

گوناگون / معرفی وب سایت / استارت آپ

10 استارت آپ برتر تاکسیرانی جهان

استارت آپ

پخت پیتزاهای هیجان انگیز با هوش مصنوعی

آینده / استارت آپ

ایده های استارتاپی فراموش شده

دورنما / بازار / استارت آپ

اپل، استارتاپ فناوری خودران Drive.ai را تصاحب کرد

استارت آپ

بررسی مهمترین چالشهای تیمهای استارتاپی

استارت آپ

نگرانی کاربران از هزینه تعمیر و تامین قطعات

گفت و گو / بازار / استارت آپ

مصاحبه با مدیرعامل و بنیانگذار استارتاپ Moz

گفت و گو / استارت آپ

آشنایی با استارت آپ های حوزه مدیریت آب

استارت آپ

راه اندازی ۷۰ استارت آپ توسط نخبگان ایرانی

استارت آپ

معرفی هشت استارتآپ موفق ایرانی در حوزه فینتک

استارت آپ

اولین مرورگر شرعی دنیا

استارت آپ

از صفر تا پیست

استارت آپ

معرفی برترین استارتاپهای CES 2019

اخبار / استارت آپ

ازدواج با فرد ثروتمند یا خوش اخلاق

سبک زندگی / برترین ها

هدف از تشکیل خانواده چیست

سبک زندگی

اول عاشق شویم، بعد ازدواج کنیم

سبک زندگی

خانواده چیست

سبک زندگی

مشاوره خانواده چیست؟

سبک زندگی

اولویتهای پسانداز خانواده چیست؟

سبک زندگی

هزینه های خانواده چیست؟

سبک زندگی

راهکار بیشتر حرف زدن اعضای خانواده چیست؟

سبک زندگی

چرخه زندگی و خانواده چیست؟

سبک زندگی

اهداف و اصول تشکیل خانواده

سبک زندگی

آموزش جنسی نادرست به سبک خانم جلسه ای

سبک زندگی

لطفا تماشاچی آزار زنان نباشید!

سبک زندگی

کودک آزاری؛ از نشانهها و دلایل تا درمان

گزارش / سبک زندگی / پرورش کودکان

روش های تعیین هدف و مسیر زندگی برای رسیدن به موفقیت

سبک زندگی

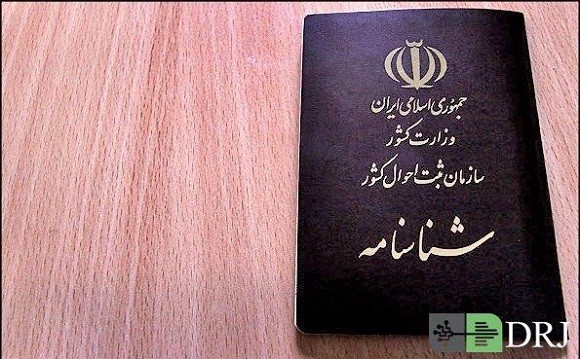

مجله اینترنتی دیپروتد نشریه مجازی بر بستر اینترنت به مسائل آموزشی و مقالات پیرامون کسب وکار های نوپا یا استارت آپ ها و سبک زندگی است فعالیت و محتوای مطالب ارائه شده در سایت همه بیشتر در حوزه مدیریت، کارآفرینی ، روانشناسی ،اقتصادی و فناوری اطلاعات است نام اصلی دیپروتد "ریشه های عمیق " با مجوز رسمی از هیات نظارت برمطبوعات مشغول به فعالیت است

ما را در شبکه های اجتماعی دنبال کنید

تمامی حقوق برای سایت فوق محفوط است.

S-TECH: ایرانی توانمند | Powered by: مجله اینترنتی دیپروتد