Even before Tesla wowed investors Wednesday with its first significant quarterly profit--$312 million--Wall Street could sense a change in the tides.

First, Tesla had suddenly announced Monday that it would report third-quarter earnings this week, instead of in early November as it usually does. The rush seemed out of character for a company that as recently as August was the most shorted stock in America, and whose CEO, Elon Musk, expressed his distaste for earnings calls by berating analysts and then trying to take Tesla private.

The hurry, analysts figured, could only mean one thing: Tesla’s earnings would be good, really good, and Musk didn’t want to wait to release them. “Does anybody think that Tesla decided to move up its earnings release date because of bad news?” wrote Andrew Left of Citron Research, a notorious short-seller, in a report published Tuesday.

It was a remarkable reversal for Left, who had been loudly shorting--or betting against--Tesla stock for more than two-and-half-years, until this week, when he declared in the report that he was now long Tesla stock. “Plain and simple, Tesla is destroying the competition,” Left wrote. “Like a magic trick, while everyone is focused on Elon smoking weed, he is quietly smoking the whole automotive industry.”

In a letter to investors Wednesday, Musk--who has publicly raged against short-sellers--offered concrete metrics of Tesla’s success.

The Model 3, which short-sellers warned would bankrupt Tesla, is now helping to drive its profitability, following through on Musk’s promise to turn a profit starting this quarter and every quarter after that.

Now, not only is Tesla’s Model 3 the best-selling electric car on the market, it’s the single best-selling car in America, period, by dollar sales. With Tesla producing 4,300 of the car each week, on average, the Model 3’s gross profit margin has climbed above 20%, and Tesla’s overall automotive gross margin is nearly 26%--not far from the holy grail of 30% that Left and other investors dream of.

Tesla’s stock rose 12% in after-hours trading following its earnings report.

Before the third quarter quarter, Tesla had only turned a profit twice since it went public--once in 2016, when it netted $30 million, and once in 2013, when it generated just more than $11 million in net income.

Its $312 million profit in the third quarter is a big swing from the prior quarter, when it lost almost $718 million. From here, investors expect Tesla’s profit to grow exponentially: $112 million in 2019, which stands to be its first profitable year, a gain that is expected to balloon 1055% in 2020, to roughly $1.3 billion.

Profitability also puts Tesla’s price-to-earnings ratio--a popular stock valuation metric--in the realm of Earth. While Tesla’s PE was impossible to calculate as long as it was losing money--you can’t divide by a negative number--it’s now trading at about 94 times its expected earnings in 2019. While that’s still extremely high (and several times the average PE ratio for the S&P 500), it’s not so far above the valuations of other high-growth tech stocks. Take Netflix, for example, which trades at 115 times estimated 2018 earnings, and 73 times 2019 earnings. Amazon’s PE, meanwhile, is 96 for this year’s expected earnings and 67 for 2019.

Now all Musk has to do is prove that Tesla deserves investors’ newfound bullishness.

ایده ها برای استارت آپ موجب رونق کسب و کارهای اینترنتی

آینده / استارت آپ

استارتآپها ادبیات بازار سرمایه را بلدند؟

استارت آپ

صدور تاییدیه دانش بنیانی شتابدهنده صدر فردا

اخبار / استارت آپ

اپلیکیشن شارژاپ

گوناگون / استارت آپ / رپرتاژ آگهی / بازتاب

جذابترین ایدههای B2B در سال 2020

استارت آپ

تعریف استارت آپ startup

دانشنامه / استارت آپ / مقاله

۱۰ استارتاپ که بدون سرمایه به سوددهی رسیدند

استارت آپ

ایده ها و پیشنهاد برای استارت آپ در سال جدید

راهکارها و ترفند ها / استارت آپ

استارتآپ ایرانی؛ مرجع اول زنان افغان

استارت آپ

شروع یک کسب و کار نوپا پلتفرمی

استارت آپ

برنامه شبکه اجتماعی تیندر

گوناگون / معرفی وب سایت / استارت آپ

10 استارت آپ برتر تاکسیرانی جهان

استارت آپ

پخت پیتزاهای هیجان انگیز با هوش مصنوعی

آینده / استارت آپ

ایده های استارتاپی فراموش شده

دورنما / بازار / استارت آپ

اپل، استارتاپ فناوری خودران Drive.ai را تصاحب کرد

استارت آپ

بررسی مهمترین چالشهای تیمهای استارتاپی

استارت آپ

نگرانی کاربران از هزینه تعمیر و تامین قطعات

گفت و گو / بازار / استارت آپ

مصاحبه با مدیرعامل و بنیانگذار استارتاپ Moz

گفت و گو / استارت آپ

آشنایی با استارت آپ های حوزه مدیریت آب

استارت آپ

راه اندازی ۷۰ استارت آپ توسط نخبگان ایرانی

استارت آپ

معرفی هشت استارتآپ موفق ایرانی در حوزه فینتک

استارت آپ

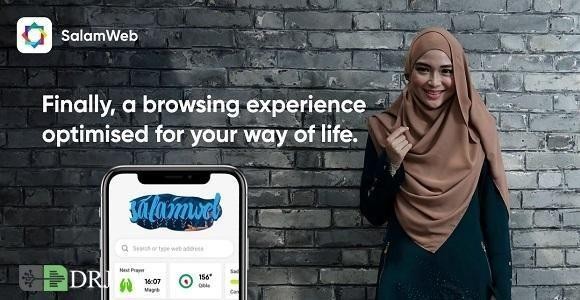

اولین مرورگر شرعی دنیا

استارت آپ

از صفر تا پیست

استارت آپ

معرفی برترین استارتاپهای CES 2019

اخبار / استارت آپ

ازدواج با فرد ثروتمند یا خوش اخلاق

سبک زندگی / برترین ها

هدف از تشکیل خانواده چیست

سبک زندگی

اول عاشق شویم، بعد ازدواج کنیم

سبک زندگی

خانواده چیست

سبک زندگی

مشاوره خانواده چیست؟

سبک زندگی

اولویتهای پسانداز خانواده چیست؟

سبک زندگی

هزینه های خانواده چیست؟

سبک زندگی

راهکار بیشتر حرف زدن اعضای خانواده چیست؟

سبک زندگی

چرخه زندگی و خانواده چیست؟

سبک زندگی

اهداف و اصول تشکیل خانواده

سبک زندگی

آموزش جنسی نادرست به سبک خانم جلسه ای

سبک زندگی

لطفا تماشاچی آزار زنان نباشید!

سبک زندگی

کودک آزاری؛ از نشانهها و دلایل تا درمان

گزارش / سبک زندگی / پرورش کودکان

روش های تعیین هدف و مسیر زندگی برای رسیدن به موفقیت

سبک زندگی

مجله اینترنتی دیپروتد نشریه مجازی بر بستر اینترنت به مسائل آموزشی و مقالات پیرامون کسب وکار های نوپا یا استارت آپ ها و سبک زندگی است فعالیت و محتوای مطالب ارائه شده در سایت همه بیشتر در حوزه مدیریت، کارآفرینی ، روانشناسی ،اقتصادی و فناوری اطلاعات است نام اصلی دیپروتد "ریشه های عمیق " با مجوز رسمی از هیات نظارت برمطبوعات مشغول به فعالیت است

ما را در شبکه های اجتماعی دنبال کنید

تمامی حقوق برای سایت فوق محفوط است.

S-TECH: ایرانی توانمند | Powered by: مجله اینترنتی دیپروتد